SAMADHAN PORTAL MSME | ONLINE APPLICATION FOR DEBT RECOVERY THROUGH SAMADHAN PORTAL

In this blog, we will learn about online application for debt recovery through samadhan portal, how to file application

INTRODUCTION:

The term MSME is the abbreviation of Micro, Small, and Medium Enterprises (MSME). According to the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the enterprises are divided into two categories, one is, the manufacturing enterprises(the enterprises which are engaged in the manufacturing or production of goods in any industry), and the other is the Service Sector.

For more information, please contact us on info@trijuris.com or call us Mb. No. 85100 58386 or 9310 717274.

Delay in Payment has been and is the biggest problem faced by the persons who are into businesses, and unfortunately, there are very few companies that pay their suppliers on time. This delayed payment of MSME creates a serious financial problem because, as a result, the money is withheld, and MSME businesses are unable to spend money further on business growth and are stuck due to limited finances. Once this money becomes an amount of monetary claim, these business organizations will be left with no other option than approaching to the respective Court or Forum and to the advocates as well for the recovery of money from the said businesses. In India, the litigation process of recovery of money is a quite lengthy and cumbersome process, and thus refunds are a big headache to the persons going through this. This litigation is also quite expensive.

RELEVANT PROVISIONS FOR RECOVERY OF MONEY THROUGH SAMADHAN PORTAL:

Under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the relevant provisions for recovering money are as follows-

- Chapter V of the micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, contains the provisions in respect of the Recovery of the Outstanding from the Buyer in case of any service availed or good brought by him/her.

- Section 15mentions that when a buyer wants to make payment in case of any services being availed or goods brought by him on or before the date as agreed in writing or before the date appointed. [The time period given to the seller is 45 days from the date of acceptance or the date of deemed acceptance].

Here ‘appointed datemeans the date following immediately after the expiry of a period of 15 days from the date of acceptance or the date of deemed acceptance of any goods or any services by a buyer from a seller or supplier.

- The Date of Acceptance means: (a) the date of the original delivery of the goods or the rendering of services; or (b) where regarding the acceptance of goods or services, any kind of objection is made in writing by the Buyer within 15 days from the day of the delivery of the goods or the rendering of the services, the day on which· such objection is made by the supplier.

- The Day of Deemed Acceptance means, regarding the acceptance of goods or services, where no objection is made in writing by the Buyer within 15 days from the day of the delivery of the goods or the rendering of services, the day of the original delivery of goods or the rendering of services.

- Section 16 states that the Buyer will be liable to pay the compound interest with monthly interests in case he fails to comply with the aforesaid provision. The rate of Interest will be three times of the bank’s rate as mentioned by the RBI.

- Section 17 states that the Buyer wants to make payment along with the rate of interest.

- Section 18 states that an MSME can refer to the Micro and Small Enterprises Facilitation Council (MSEFC), and the said MSEFC can take some action or initiative on its own, as it may deem necessary.

MICRO AND SMALL ENTERPRISE FACILITATION COUNCIL (MSEFC):

Micro and Small Enterprise Facilitation Council, which is known as MSEFC, is established under the MSMED Act to take up the matters with reference to any amount which is due from the Buyer of the goods and services rendered. The MSEFC contains 2-5 members:

- Director of such Industries.

- One or more office-bearers or representatives of MSME’s associations in the State.

- One or more banks or the financial institutions are lending to the MSMEs.

- One or more persons are having special knowledge in regard to industry, finance, law, trade, or commerce.

For more information, please contact us on info@trijuris.com or call us Mb. No. 85100 58386 or 9310 717274.

PENAL INTEREST ON DELAYED PAYMENT:

If a dispute arises in case of the payment of principal or interest between the seller or supplier and the borrower, the reference shall have to be made to the jurisdiction of the Micro and Small Enterprises Facilitation Council (MSEFC),which is now widely known as the ‘MSME Court’ constituted by the respective State Governments. After examining the case filed by the MSME unit, an MSEFC of the State will issue some directions to the Buyer for payment of due amount along with interests as per the provisions of the Act. Every reference made to MSEFC shall be decided within a period of 90 days from the date of making such a reference as per the provisions laid in the Act.

ONLINE APPLICATION FOR DEBT RECOVERY THROUGH SAMADHAN PORTAL:

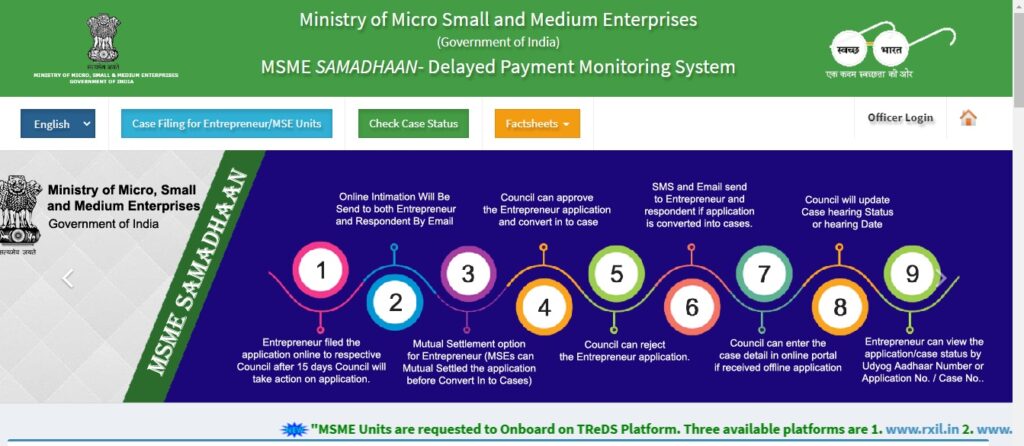

Once an issue has been submitted under the MSEFC, an online notification is sent to both parties. An opportunity of peaceful settlement is offered to both parties through reconciliation. After the failure of the conciliation process, the MSEFC decides whether the matter will be treated as litigation or rejected, and if it is accepted as a matter of litigation, it is directly referred to the arbitration process. MSEFC delivers the final award of the arbitration. The said award must be discussed with the Interim Resolution Professional and the Hon’ble National Company Law Tribunal (NCLT) during the insolvency procedure wherein the party having the award is treated as a secured debtor. This award can also be made to a foreign buyer. The process of executing such an award lies under the arbitration and Conciliation Act, 1996. Here the Buyer cannot file any appeal against the award.

Three consecutive notices of such order are given to the respondent. Afterwhich, a notice is also published in the daily newspaper in the area of the respondent’s location. The silence of the Buyer is treated as a confirmation of their liability. Buyer’s offenses will be tried in the Court of Law, under the Metropolitan Magistrate or a First Class Magistrate or a High Court. The jurisdiction of the State Council may be extended to a district without a council.

FILING A CASE BEFORE THE MSEFC:

For the purpose of delayed payment, the Office of Development Commissioner of the MSME has taken the great initiative to file an online application by the supplier of the MSME unit against the Buyer of goods or services before the respective MSEFC. At the same time for filing such an application, the Government has undertaken an online payment monitoring system called the MSME Samadhaan. An MSME, having the valid Udyog Aadhaar Memorandum(UAM) can make such an application with the help of this portal. Once an application is successfully made by the MSME, the MSEFC shall examine the said case and issue certain directions to the Buyer for payment of the due amount along with some interest.

FILING AN MSME PETITION ON THE MSME PORTAL:

In order to file a petition under the MSME portal, the following steps should be kept in mind-

- The first step is to open the online portal of the MSMED Samadhaan. After which, the applicant should click on Case Filing for Entrepreneur/MSME.

- Under the said option, the applicant should enter Udyog Aadhaar Number (UAM), which will be received by Business Entities when an MSME Certificate is issued.

- The applicant should enter his Aadhaar Number or Mobile Number as in Udyog Aadhaar(for Assisted filing cases).

- After which a verification code will be sent in the mobile number, the applicant should enter the verification code correctly.

- After which, the applicant should click on the Validate Udyog Aadhaar button to receive an OTP on email registered during the Udyog Aadhaar registration.

- Cases can be easily updated from the said website by any aggrieved party.

- Next, the applicant will see an option named ‘Application entry’, which will help in filing an application and/or compliant with the appropriate authority, before filling it, the applicant should keep ready all the details of work orders and/or details of invoices or any other essential documents which can prove the claim. The applicant can provide the details over the portal if it is less than 5.But, in case it is more than five, then the applicant can combine all the invoices in a single PDF and upload it over the online portal and submit it there.

- After which, a page will pop up along with the option of review and final submission.

- Once everything is done, MSEFC will send this application to the concerned respondent, and the status of the complaint can be seen on the website under the option of the Entrepreneur Application list. The application will proceed quicker than that of the court. Furthermore, the concerned officer may enquire the applicant and ask the applicant to come and give him any other document and/or information being required by him.

The person who files the case is called the Aggrieved Party or the Claimants, and the person against whom the case is filed is called the Opposite Party or the Respondents.

The vital advantage of the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006 is that MSME overrides the Contractual Arbitration clause between the Parties (GET & D India Limited –vs- Reliable Engineering 2017 SCC Online 6978).

CONCLUSION:

The sector of Micro, Small, and Medium Enterprises (MSME) has emerged as the most dynamic sector of the Indian economy over the past few years. It contributes significantly to the economic and social development of the Country by providing economic growth and promoting equal development and entrepreneurship, and creating large-scale employment opportunities at relatively lower costs, like in the field of agriculture. Since this sector is engaged with different industries, it provides a major share in promoting employment among various persons, and thus this industry works as a backbone of our Country. When it comes to the significance of industrial development, the importance of this sector is remarkable. MSME extends its domains to all sectors of the economy, thus producing a wide range of products and services to fulfill the needs of local and international markets.

With the latest amendments in the MSMED Act and the Insolvency and Bankruptcy Code (IBC) announced by the Government of India since the outbreak of the COVID-19 pandemic, the scope of MSME has been widened, thereby in a way towards the protection of the stable economy in our Country.

If you found any error don’t forget to provide your suggestions at info@trijuris.com or call us Mb. No. 85100 58386 or 9310 717274.

READ MORE ARTICLES:

2 thoughts on “SAMADHAN PORTAL MSME | ONLINE APPLICATION FOR DEBT RECOVERY THROUGH SAMADHAN PORTAL”